State of the Union 2016: The European Fund for Strategic Investments - Frequently Asked Questions

2016-09-16

Strasbourg, 14 September 2016

What is the Commission proposing today?

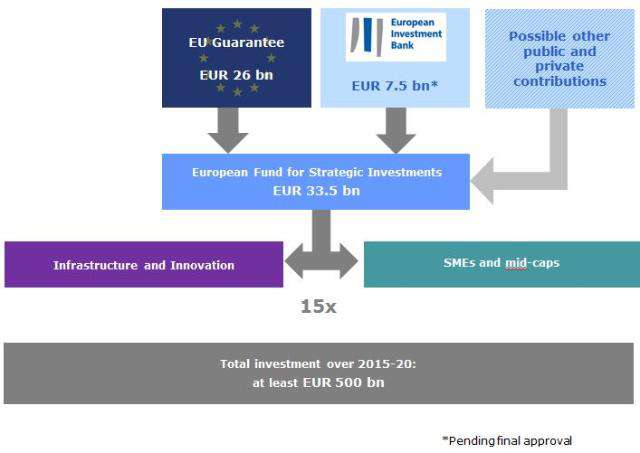

Investment helps to boost jobs, in particular for young people, and supports growth, both in Europe and globally. It is one of the European Commission’s top priorities. That is why the Commission announced the Investment Plan for Europe only three weeks after taking office, with the European Investment Bank (EIB) as its strategic partner in the Plan. At the heart of the Plan is the European Fund for Strategic Investments (EFSI). The EFSI was established for an initial period of three years, with the aim of mobilising at least EUR 315 billion in investments with maximum private sector contributions.

Given the EFSI's success in its first year, the Commission is committed to the doubling of the EFSI, both in terms of duration and financial capacity. It therefore presents today a legal extension that covers the period of the current Multiannual Financial Framework and should provide a total of at least half a trillion euro investments by 2020. In order to enhance the firepower of the EFSI even further and reach the aim of doubling the investment target, the Commission calls on Member States to also contribute as a matter of priority.

For the period after 2020, the Commission intends to put forward proposals to ensure that strategic investment will continue at a sustainable level. This should provide stability and certainty for investors and project promoters going forward.

The Investment Plan is successful but young. Beyond extending EFSI, the Commission proposes to draw on the lessons learnt in its first year of implementation by making a number of technical improvements for the EFSI and the European Investment Advisory Hub.

A key element of the proposal is a further reinforcement of the concept of additionality for projects supported under the EFSI. That is to say that only projects that would not have happened at the same time or to the same extent without EFSI financing should be chosen. Projects under the EFSI need to address sub-optimal investment situations and market gaps as part of the eligibility criteria. The quality of investments needs to be ensured at the same time as volumes. Also, in view of their importance for the Single Market, cross-border infrastructure projects (including services) have been specifically identified as providing additionality. Moreover, the EFSI will in the future focus even more on sustainable investments across sectors to help to meet COP21 targets and helping the transition to a resource efficient, circular and zero-carbon economy. The Commission also proposes an even larger share of financing for small and medium-sized enterprises SMEs given that the EFSI has delivered well beyond expectations for SMEs.

An important objective of the extension of the EFSI is to enhance the geographical coverage of the EFSI and to reinforce the take-up in less developed regions. In this respect, the Commission will aim to make it easier to combine EFSI with other sources of EU funding. In addition, the European Investment Advisory Hub will concentrate its efforts and resources on projects that contribute to the sectorial and geographical diversification of the EFSI.

Finally, the proposal will enhance transparency of the investment decisions and governance procedures. The Investment Committee will be obliged to explain its decisions even further and give the reasons why it deems that a particular operation should be granted EFSI support. A scoreboard of indicators should be published for each operation after signature excluding commercially sensitive information.

Why are you extending the EFSI?

Efforts need to continue to bring investment back to its long-term sustainable trend. The mechanisms of the Investment Plan, including the EFSI, work and should be reinforced to continue mobilising private investments in key sectors for Europe, where market failures or sub-optimal investment situations remain.

A thorough implementation of the third pillar of the Investment Plan - removing barriers to investment - is also needed to complement the EFSI's contribution, improve the investment environment and boost Europe's economy and growth.

The EFSI has had a successful first year. The projects and agreements approved for financing under the EFSI so far (by 14 September 2016) are expected to mobilise EUR 116 billion in total investments across 26 Member States and to support some 200,000 SMEs.

EFSI is therefore delivering concrete results and encouraging a sustainable increase in the low investment levels in Europe after the financial crisis. To further boost investment, to avoid disruptions in financing and to assure project promoters that they can still prepare projects even after the initial investment period, the Commission proposes to extend the EFSI over time and to increase its fire power.

This proposal foresees the extension to at least half a trillion euro investments by 2020, i.e. until the end of the current Multiannual Financial Framework. For the period after 2020, the Commission intends to put forward the necessary proposals to ensure that strategic investment will continue at a sustainable level.

You have increased the SME window by EUR 500 million: why and where did the money come from?

Given its success, the EFSI Steering Board scaled up the EFSI SME window already in July 2016 under the current framework, for the benefit of SMEs and mid-cap companies in all Member States. EUR 500 million of the EU guarantee was transferred from the Infrastructure and Innovation window to the SME window. The EU guarantee under the EFSI will be used to top up InnovFin and COSME loan guarantee instruments as well as the EU Programme for Employment and Social Innovation (EaSI) and the development of new products.

This will lead to an increase in the overall volume of operations for these instruments and will allow the EIF to finance a significant extra volume of operations, all under the current EFSI framework.

Increasing the resources of the SME window shows our commitment to supporting one of the greatest successes of the EFSI so far, especially as SMEs are the backbone of the European economy.

Are you confident you will reach the new investment target of EUR 500 billion?

The projects and agreements approved for financing under the EFSI so far

(by 14 September 2016) are expected to mobilise EUR 116 billion in total investments across 26 Member States and to support some 200,000 SMEs.

The EFSI's promising start shows that the ambition to mobilise EUR 500 billion in additional investments by 2020 is based on conservative assumptions and well founded.

Where will the money come from?

The proposal does not require changes to the Multiannual Financial Framework.

The package is constructed to ensure that its impact is financially neutral to the greatest possible extent. In order to reinforce the guarantee fund to support the extended guarantee, some existing instruments are recalibrated, combined with a very limited use of the unallocated margins of the EU budget.

Will the targeted leverage effect of 1:15 remain the same under the extended EFSI?

Yes, the targeted leverage effect of 1:15 has proven to be realistic, based on the EFSI's operations so far. It will remain unchanged under the extended EFSI.

How will you improve the EFSI's geographical coverage concretely?

The proposal places a stronger emphasis on leveraging local knowledge to facilitate EFSI support across the EU. The European Investment Advisory Hub (EIAH) will provide more targeted technical assistance services at local level across the EU, and the Commission will encourage the EIB to extend its local outreach in the Member States.

In addition, it will become easier to combine EFSI financing with support by other sources of EU funding - including European Structural and Investment (ESI) Funds. The Commission also proposes today a simplification of the Common Provisions Regulation to facilitate such combination.

What is the role of National Promotional Banks (NPBs)? Will anything change with the extension of the EFSI?

In partnership with the EIB, NPBs play a key role in the implementation of the Investment Plan, including the EFSI, as their product ranges, local knowledge and geographical reach are complementary. They will remain key in the extended EFSI, including in co-financing projects with the EIB and other investors. The involvement of NPBs also remains crucial for the local work of the enhanced European Investment Advisory Hub (EIAH). So far, 18 NPBs as well as the International Union of Railways have agreed to build partner networks with the EIAH to exchange best practice and enhance the local contact with project promoters.

And how will you enhance the EFSI's sectorial coverage?

The proposal extends the focus to more sectors, such as agriculture and industries in less-developed regions and transition regions. The proposal also encourages enhancing technical assistance to projects in different sectors, with particular attention to projects that contribute to climate action in line with the COP21 objectives as well as projects involving cross-border infrastructure investments. The European Investment Advisory Hub will provide technical assistance together with National Promotional Banks and other local actors. They will also seek cooperation with other international partners such as the European Bank for Reconstruction and Development (EBRD) to cover advisory areas currently not served by the EIB, for example to provide advice for small businesses in some cohesion countries.

How will you ensure that EFSI projects are sustainable and in line with COP21 objectives?

Energy efficiency is undoubtedly one of the most prominent sectors under the EFSI. For instance, the vast majority of projects approved for EFSI financing in the energy sector so far (23% of EFSI investment) cover the renewable energy and energy efficiency sectors. A further 5% of EFSI investment covers the environment and resource efficiency sector. Thus, almost a third of the EFSI investments so far support environmentally-friendly projects.

In the future, the EFSI will focus even more on sustainable investments in all sectors to contribute to meeting COP21 targets and to help to deliver on the transition to a resource efficient, circular and zero-carbon economy. Today the Commission proposes that at least [40%] of EFSI projects under the infrastructure and innovation window should contribute to climate action in line with the COP21 objectives. In addition, the Commission proposes that the European Investment Advisory Hub further supports the preparation of climate-friendly projects, in particular in the context of COP21.

How are you improving transparency about how projects are selected? Has the scoreboard been used in the decision making of the EFSI?

The Commission proposes that the EFSI Investment Committee should explain its decisions and give the reasons for granting support under the EU guarantee for each operation. These explanations should be made publicly accessible. The Commission also proposes the publication of the scoreboard for EFSI projects as soon as they are signed, excluding commercially sensitive information.

The scoreboard is already a useful tool for the Investment Committee. It helps to ensure a thorough assessment of possible use of the EU guarantee. Its publication will provide additional transparency in the selection of the EFSI projects against measurable criteria.

Have EFSI projects provided additionality or have they just been "EIB business as usual"?

The EFSI projects must be 'additional' in the sense that they point to market failures or suboptimal investment situations and therefore would – in principle – not have been financed in the same period by the EIB without the EFSI support, or not to the same extent. The level of risk is an essential element of how to assess the additionality of projects supported by the EFSI guarantee.

Our evaluation shows that the EFSI has changed how the EIB operates and that it is not supporting business as usual by the EIB but is financing riskier and more innovative projects. In fact, under the infrastructure and innovation window, the EU guarantee allowed the EIB to expand significantly the volume of its special activities, i.e. higher risk. In the first year of the EFSI, the volume of approved operations was EUR 11 billion. In the SME window, the EFSI has allowed the EIF to increase considerably the volume of financing to SMEs and mid-caps.

The level of risk is an essential element of how to assess the additionality of projects supported by the EFSI guarantee. All operations approved by the EIB so far carry a risk corresponding to so-called EIB Special activities. As a result, the EIB is committed to increasing the volume of its portfolio of higher risk/Special activities, from around EUR 4 billion to more than EUR 20 billion per year.

When approving projects for backing by the EU budget guarantee, the independent EFSI Investment Committee uses strict criteria laid down in the EFSI Regulation and agreed by Member States and the European Parliament. The EU budget guarantee can only be extended to projects which demonstrate a good use of taxpayers' money and fulfil all the criteria of the EFSI Regulation.

The Commission proposal foresees an even more transparent decision-making process for the Investment Committee so that all stakeholders can easily identify the additionality and added value of EFSI projects.

Has the EFSI increased the EIB financing activities?

The main objective of the EFSI is to allow the EIB to focus on investments which truly address market gaps and sub-optimal conditions. Those investments are by nature riskier: if it were not the case, the market could easily finance them in the same period of time and under the same conditions without EFSI support. All EIB activities under the EFSI cover investments which the EIB rates as risky. The target volume of risky activities set by the EIB Board is de facto multiplied by four, compared to the pre-EFSI period.

Is the governance of the EFSI solely in the hands of the EIB?

The EFSI is a joint initiative by the Commission and the EIB Group and it has a dedicated governance structure.

A fully independent Investment Committee decides which projects will be backed by the EU guarantee, without interference by the EIB, the Commission or any other public or private contributors. Since the EFSI operates within the EIB, any project supported by the EFSI will also require final approval according to the EIB’s regular procedures.

A Steering Board, composed of Members from the Commission and the EIB, decides on the overall strategic orientation of the EFSI.

The EFSI has a Managing Director who is supported by a deputy Managing Director. The Managing Director is responsible for the day-to-day management of the EFSI. He chairs Investment Committee meetings and is the public face of the EFSI. The Managing Director can be requested to attend hearings at the European Parliament on the performance of the EFSI and is obliged to reply swiftly to Parliamentary questions.

Why are you coming out with this proposal earlier than expected?

The Commission announced on 1 June that it would present a proposal in the Autumn. The European Council on 28 June concluded that the European Parliament and the Council should examine such a proposal as a matter of urgency.

The legislative proposal builds on the success of the EFSI so far and allows for a smooth continuation of the operations. This will avoid disruptions in financing and assure project promoters that they can still prepare projects even after the initial investment period.

What does the Commission's evaluation say about the EFSI's first year? Why are there three separate evaluations coming at different times?

The Commission and the EIB prepare three separate evaluations in line with the requirements of the EFSI Regulation. The evaluation just issued by the Commission relates to the use of the EU guarantee and the functioning of the guarantee fund, whereas the evaluation to be released by the EIB in the coming weeks concerns the functioning of the EFSI. Furthermore, the Commission has decided to bring forward the independent external evaluation of the application of the EFSI Regulation, so that it too can feed into the upcoming debate on the legislative proposal on the extension of EFSI. This third evaluation will be ready in November.

The Commission's evaluation published today finds that after the first year of experience the use of the EU guarantee has proved to be an efficient and effective way to increase considerably the volume of riskier EIB activities and EIF guarantees to SMEs and mid-caps.

The evaluation has also concluded, based on around 300 operations, that some recalibration of the guarantee fund is possible.

What has been the macroeconomic impact of the Investment Plan so far?

The start of the Investment Plan has been promising. However, it cannot change the investment environment on its own. It is also too early to say with any certainty what the impact of the Plan is so far. The macro-economic impact of the Plan will unfold in the years to come. Projects, particularly for infrastructure, take a long time to prepare and structure and are disbursed progressively, over many years. However, we expect that the Plan as a whole, not only the EFSI but also the new projects generated with the help of the European Investment Advisory Hub and the European Investment Project Portal and the efforts to remove bottlenecks to investment, will all have a significant positive impact on the EU's growth. More precise assessments will be made at a later stage, once more data are available.

What accounting aspects have been clarified for public-private partnerships (PPPs)?

A guide to the statistical treatment of public-private partnerships (PPPs), produced by Eurostat in cooperation with the EIB will be released on 29 September. The guide aims to provide more clarity on the rules on the statistical treatment of PPPs by Eurostat in its Manual of Government Deficit and Debt. The guide will be addressed to PPP practitioners of the private and public sector. As preparatory work, an extensive stock-taking exercise on the application of typical provisions in PPP contracts was carried out. The guide clarifies how the rules on the statistical treatments of PPPs should be applied to such typical contractual provisions.